startstopcontinue.online

Community

Which Uses Your Credit History To Determine Your Credit Score

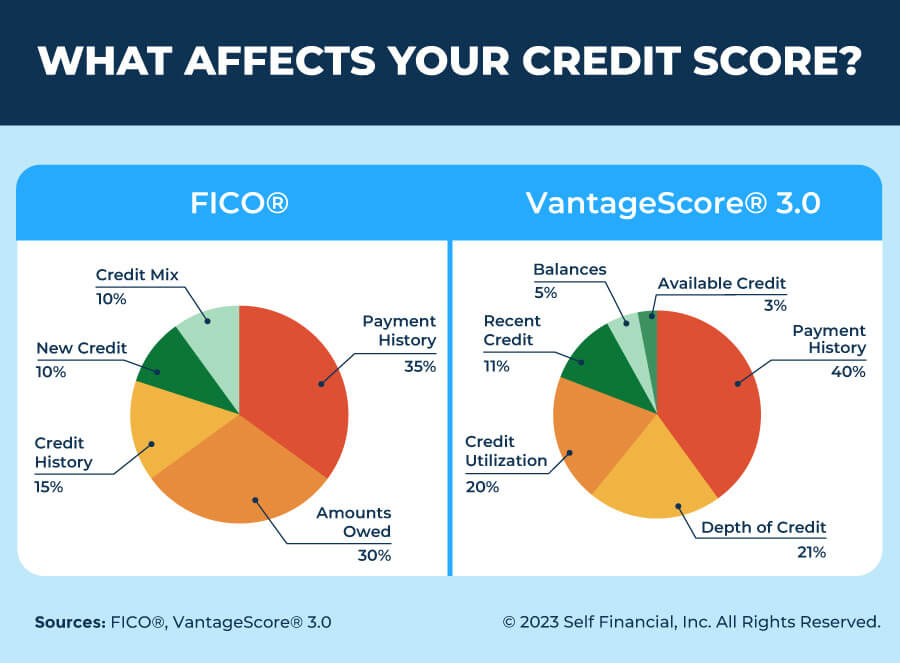

We get it, credit scores are important. A monthly free credit score & Equifax credit report are available with Equifax Core CreditTM. No credit card required. Lenders use different information and credit scoring models (usually either FICO or VantageScore) depending on their needs — for example, a mortgage lender will. Your FICO Scores are calculated using five categories: payment history, amounts owed, new credit, length of credit history and credit mix. The two major scoring systems are VantageScore and Fair Isaac Corporation (FICO). FICO has five categories that help to determine your score while VantageScore. Payment history, the number and type of credit accounts, your used vs. available credit and the length of your credit history are factors frequently used to. Credit scores typically fall in one of the credit score ranges that determine if your credit is excellent, good, fair or poor. Learn how to take your score. Your credit report lists what types of credit you use, the length of time your accounts have been open, and whether you've paid your bills on time. A credit score is a number that's calculated based on the information in your credit report. It helps businesses predict how likely you are to repay a loan and. Financial institutions use your credit score to decide whether to offer you a loan or credit card. Your credit score also determines the interest rates and. We get it, credit scores are important. A monthly free credit score & Equifax credit report are available with Equifax Core CreditTM. No credit card required. Lenders use different information and credit scoring models (usually either FICO or VantageScore) depending on their needs — for example, a mortgage lender will. Your FICO Scores are calculated using five categories: payment history, amounts owed, new credit, length of credit history and credit mix. The two major scoring systems are VantageScore and Fair Isaac Corporation (FICO). FICO has five categories that help to determine your score while VantageScore. Payment history, the number and type of credit accounts, your used vs. available credit and the length of your credit history are factors frequently used to. Credit scores typically fall in one of the credit score ranges that determine if your credit is excellent, good, fair or poor. Learn how to take your score. Your credit report lists what types of credit you use, the length of time your accounts have been open, and whether you've paid your bills on time. A credit score is a number that's calculated based on the information in your credit report. It helps businesses predict how likely you are to repay a loan and. Financial institutions use your credit score to decide whether to offer you a loan or credit card. Your credit score also determines the interest rates and.

VantageScore: Founded in by Equifax, Experian and TransUnion. The company uses several different formulas to calculate credit scores—including VantageScore. A credit score is a three-digit number calculated from data on your credit report. A complex algorithm called a scoring model is used to compute your credit. FICO Score. You may have seen the term “FICO score” on a credit report. This scoring model is used by the three major credit bureaus: Equifax. FICO scores take into account your payment history, how much debt you have, types of credit used, length of credit history, and new credit accounts, to. Lenders calculate your credit score using information in your credit report, like your history of repaying money you borrowed, the types of loans you've had. A credit score of or above is generally considered good. A score of or above on the same range is considered to be excellent. Credit bureaus don't calculate credit scores on their own. Credit-scoring companies, such as VantageScore and FICO, do. They use mathematical formulas called. Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score. Credit scoring is based on data from your credit report, including payment history and the amount you owe. FICO® and VantageScore® are the 2 most used types of. Your credit score is based on your credit habits. There are different companies that review your credit history and provide a score to lenders for their. Your credit score is a numerical calculation based on the information in your credit report your FICO score, is used by lenders to determine your credit. A credit score is a 3-digit number that reflects the likelihood that a consumer will repay his debts. With so many scoring models used to determine your credit. Your credit score is calculated based on the activity on your credit reports, provided by the three credit bureaus — Experian, Equifax and TransUnion. The two. Credit scores are calculated using five key factors including payment history, credit utilization, credit length, amount of credit and credit mix. Lenders, such as banks and credit card companies, use credit scores to evaluate the risk of lending money to consumers. Lenders contend that widespread use of. Can I see my credit report? · call Annual Credit Report at or · go to startstopcontinue.online A credit score is a personalized three-digit number based on a consumer's credit history. Lenders use credit scores to decide whether or not to offer people. Lenders, employers, insurers and landlords can make decisions based on the contents of your report, and that information also determines your credit score. Lenders may use your credit report information to decide whether you can get a the credit score or scores that were used to determine whether the lender would. To calculate this, they use either the VantageScore model or the FICO model. Both of the scoring models are used widely and are important, but the way each.

Best Financing Options For Business

Crowdfunding. If you have a network of friends and family, or eager fans or customers, crowdfunding may be an option for you. Using online platforms. 1. Friends and family · 2. Bootstrapping and self-funding · 3. Business loans · 4. SBA loans · 5. Venture capital and angel investors · 6. Crowdfunding · 7. Grants · 8. Banks that offer small business loans. Banks that offer business loans include: Chase; Wells Fargo; U.S. Bank; Capital One; Bank of America; American Express. Finance your small business with business loans from Chase. Find a variety of financing options including SBA loans, commercial financing and a business line of. HELPING YOUR SMALL BUSINESS ACHIEVE BIG GOALS · FUNDING IN AS LITTLE AS HOURS · PERSONALIZED SERVICE · FLEXIBLE PLANS THAT EVOLVE WITH YOUR BUSINESS · Meet. Equity buyout - buying out the ownership of the business with the idea of taking control. · Convertible Debt - Providing a loan to the business. According to the SBA, P2P lending can be a solid financing alternative for small businesses, especially amid post-recession credit markets. One drawback of this. Family members, angel investors, venture capitalists, or private lending organisations can all be considered. It is a source of funding that a business owner. There are many ways to finance your new business. You could borrow from a certified lender, raise funds through family and friends, finance capital through. Crowdfunding. If you have a network of friends and family, or eager fans or customers, crowdfunding may be an option for you. Using online platforms. 1. Friends and family · 2. Bootstrapping and self-funding · 3. Business loans · 4. SBA loans · 5. Venture capital and angel investors · 6. Crowdfunding · 7. Grants · 8. Banks that offer small business loans. Banks that offer business loans include: Chase; Wells Fargo; U.S. Bank; Capital One; Bank of America; American Express. Finance your small business with business loans from Chase. Find a variety of financing options including SBA loans, commercial financing and a business line of. HELPING YOUR SMALL BUSINESS ACHIEVE BIG GOALS · FUNDING IN AS LITTLE AS HOURS · PERSONALIZED SERVICE · FLEXIBLE PLANS THAT EVOLVE WITH YOUR BUSINESS · Meet. Equity buyout - buying out the ownership of the business with the idea of taking control. · Convertible Debt - Providing a loan to the business. According to the SBA, P2P lending can be a solid financing alternative for small businesses, especially amid post-recession credit markets. One drawback of this. Family members, angel investors, venture capitalists, or private lending organisations can all be considered. It is a source of funding that a business owner. There are many ways to finance your new business. You could borrow from a certified lender, raise funds through family and friends, finance capital through.

Whether you opt for a bank loan, a grant, a business incubator, or even friends and family, all of these financing options can be combined, although each one. Drive more traffic, increase sales, and build customer loyalty by offering customer financing. Learn how Synchrony can support your business. If you don't fall into the traditional categories of business funding, a flexible loan is your best bet. They offer a variety of terms, credit line amounts and. Business term loans offer a lump sum you repay in installments plus interest and fees. Term loans come in short-term and long-term loan options. They're best. Get matched to an SBA-approved lender and find the best loans to start and grow your small business. Find lenders. Need help? Get free business counseling. Find. OnDeck offers two loan options — a term loan and a line of credit — to meet your unique business needs. A small business loan from OnDeck provides rapid funding. If you have a good credit score and at least two years in business, SBA loans are probably the best option for you. 3. Seller Financing. Seller financing is. Starting with personal financing and credit lines · Reaching out to friends and family · Applying for a business loan · Catching the attention of an angel investor. You can qualify for our top financing options with as little as 3+months in business. $5,+ Monthly Gross Sales. Small Business Administration Loans, or SBA Loans, are partly guaranteed by the government which makes them some of the best options available for small. Best small business loans · Best for multiple types of loans: Biz2Credit · Best for same-day funding: OnDeck · Best for no prepayment fees: Funding Circle · Best. In general, banks and credit unions are best for more established businesses because of the stricter approval requirements. Online lenders and nonprofits may be. Once approved, a small business loan advisor will reach out to you with the options you qualify for and help you choose the best business loan or financing. These options include term loans, commercial real estate loans, and SBA loans. This kind of financing is best used for businesses seeking to acquire or expand. Debt and equity are the two major sources of financing. Government grants to finance certain aspects of a business may be an option. Also, incentives may be. The best way to get capital to grow your business · Bootstrapping · Loans from friends and family · Credit cards · Crowdfunding sites · Bank loans · Angel investors. Business lines of credit are one of the best small business loans if you're looking for flexibility. It allows businesses to withdraw a certain amount of cash. With business loans hard to secure, funding from family and friends is often more readily available. If your loved ones believe in your business venture, they. Flexibility: As long as the usage of your funds aligns with the terms and requirements set out by your lender, you can use them in whatever way best supports. National Funding offers a wide range of small business financing options to cater to the unique needs of your business. Choose Your Type of Small Business Loan.

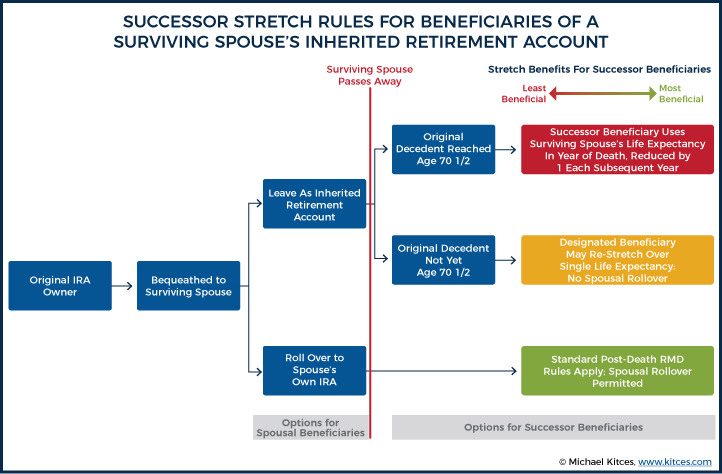

Rollover To Traditional Ira Rules

The day rollover rule requires that you deposit all the funds from a retirement account into another IRA, (k), or another qualified retirement account. The individual must have met the 2 year rule applying to the SIMPLE-IRA plan. Presently you may have some customers who have both a traditional IRA and a. A regular contribution is the annual contribution you're allowed to make to a traditional or Roth IRA: up to $6, for , $7, if you're 50 or older. You can roll over your traditional (k) or (b) into a Roth IRA, but this will be considered a Roth conversion which is a taxable event I want to. An IRA transfer refers to the movement of funds between the same types of accounts with no IRA distribution to you. For example, you could move IRA funds from. IRS rules limit you to one rollover per client per twelve month period. For more information on rolling over your IRA, (k), (b) or SEP IRA, visit Should I. Within 60 days of receiving the distribution check, you must deposit the money into a Rollover IRA to avoid current income taxes. If taxes were withheld from. You can roll assets from one IRA to another IRA in any one-year period, but only to indirect rollovers — it does not count for direct transfers. Put simply, the. A rollover IRA is a type of traditional IRA and shares the same tax rules. The only difference is that money in a rollover IRA can later be rolled over into an. The day rollover rule requires that you deposit all the funds from a retirement account into another IRA, (k), or another qualified retirement account. The individual must have met the 2 year rule applying to the SIMPLE-IRA plan. Presently you may have some customers who have both a traditional IRA and a. A regular contribution is the annual contribution you're allowed to make to a traditional or Roth IRA: up to $6, for , $7, if you're 50 or older. You can roll over your traditional (k) or (b) into a Roth IRA, but this will be considered a Roth conversion which is a taxable event I want to. An IRA transfer refers to the movement of funds between the same types of accounts with no IRA distribution to you. For example, you could move IRA funds from. IRS rules limit you to one rollover per client per twelve month period. For more information on rolling over your IRA, (k), (b) or SEP IRA, visit Should I. Within 60 days of receiving the distribution check, you must deposit the money into a Rollover IRA to avoid current income taxes. If taxes were withheld from. You can roll assets from one IRA to another IRA in any one-year period, but only to indirect rollovers — it does not count for direct transfers. Put simply, the. A rollover IRA is a type of traditional IRA and shares the same tax rules. The only difference is that money in a rollover IRA can later be rolled over into an.

traditional IRA, the only real difference is that the money in a rollover IRA was rolled over from an employer-sponsored retirement plan. Otherwise, the. SIMPLE IRA accounts cannot accept inbound transfers from non-SIMPLE accounts, however, and may only be transferred to a non-SIMPLE account after the SIMPLE. A transfer may occur between two Traditional IRAs (including those with SEP plan contributions), two Roth IRAs, two SIMPLE. IRAs, and between a SIMPLE IRA* and. People are generally only allowed to make one rollover from the same IRA within a month period. · If someone does not transfer money directly to a retirement. It is a process that allows you to move funds from your previous employer-sponsored retirement plan, a (k), for example, into an IRA. You can only do an IRA-to-IRA rollover once every 12 months, although there are some exceptions. You'll want to familiarize yourself with this information to. An IRA rollover (also known as IRA transfer) is a way to take your previous (k) retirement account with you, but there are tax impacts to be aware of. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. withdrawal penalty. IRA Comparison Reference. Traditional IRA. Roth IRA. Are there differences between. Pennsylvania and federal tax rules on roll-over. If you roll over your funds into a traditional IRA or eligible If you roll over into a Roth IRA, the rules could be different. Check with. To contribute to a traditional IRA, you must have earned income. Your contributions are limited to $7, or % of your earned income, whichever is lower. The day rollover rule requires that you deposit all the funds from a retirement account into another IRA, (k), or another qualified retirement account. In order for the transaction to qualify as a rollover, the money being moved must be withdrawn from the old account and deposited in another account within Key Features · A rollover IRA is not a different IRA. It's a Traditional IRA or Roth IRA that you are using to consolidate your retirement accounts. · Most plans. You can pay taxes on your account to move your savings to a Roth IRA, letting you enjoy the potential for future tax-free growth. Roll over your (k) to a Traditional IRA · Your money can continue to grow tax-deferred. · You may have access to investment choices that are not available in. A Roth conversion is the process of repositioning your assets in a Traditional IRA or an eligible distribution from your qualified employer sponsored. To avoid abusing the rule, the tax code prescribes that taxpayers can only complete an IRA rollover once a year. Or, once in a twelve-month period. In the past. The IRA one-rollover-per-year rule is a tax law that limits the number of times you can roll over money from one IRA to another in a given year. The following rules apply: a. Rollover into a Traditional IRA or a Roth IRA. You can roll over your after-tax contributions to a traditional IRA.

How To Find Someones Finsta

The key thing when finding out how to make a Finsta username is to avoid anything too obvious, or that could identify you, in case you want to stay incognito. InstaFinsta – Best Instagram Downloader The first thing you need to do is open the Instagram app and find the video that you want to download. every single social channel that someone has. You go to this website. and you type in their email. or you type in one of their social handles. If you know it. So my introduction to Finstagram was pretty much out of blue and very, very unexpected. I was scrolling through my discover page, gazing at pictures of cute. How do you find someone's finsta or sinsta? Right now there isn't any particular way to find someone's finsta or sinsta that's as easy as using a search box. You know it is bad when a sorority expels someone for being a classist and a bully. The user provides evidence of Jodie Turner-Smith being listed as expelled. To find every Instagram account owned by someone, all you need to do is enter their phone number into the search bar below. If one of your followers reported your private posts to a school supervisor or someone else or employer there could be consequences. Once you find out your. Things You Should Know · Go to your profile page > ≡ > Settings > Add Account to make your finsta account. · Make sure your username and profile photo don't. The key thing when finding out how to make a Finsta username is to avoid anything too obvious, or that could identify you, in case you want to stay incognito. InstaFinsta – Best Instagram Downloader The first thing you need to do is open the Instagram app and find the video that you want to download. every single social channel that someone has. You go to this website. and you type in their email. or you type in one of their social handles. If you know it. So my introduction to Finstagram was pretty much out of blue and very, very unexpected. I was scrolling through my discover page, gazing at pictures of cute. How do you find someone's finsta or sinsta? Right now there isn't any particular way to find someone's finsta or sinsta that's as easy as using a search box. You know it is bad when a sorority expels someone for being a classist and a bully. The user provides evidence of Jodie Turner-Smith being listed as expelled. To find every Instagram account owned by someone, all you need to do is enter their phone number into the search bar below. If one of your followers reported your private posts to a school supervisor or someone else or employer there could be consequences. Once you find out your. Things You Should Know · Go to your profile page > ≡ > Settings > Add Account to make your finsta account. · Make sure your username and profile photo don't.

Strange to think there was a point in time when I did not know what a finsta was. someone exclusively to engage with. This sentiment of the empathetic. Social media comes in many forms, but one of the most popular platforms is Instagram. It's important to know how to protect your information on Instagram so you. You'll find the same search bar here, which will ask for a username instead someone's Instagram photo. Account holders are entitled to opt for. Using your full name as your username means that those who know you can find you quickly by searching for you. For instance, if someone searches for you on. Often, they will follow their own secret account. Keep in mind the username of their secret account will be under an alias name so it may be difficult to find. Finsta = Fake Instagram. Usually it's someone's second, less-public Lowkey = A warning that someone doesn't want everyone to know what they're saying. “Finsta” accounts are most often a secondary Instagram account for an individual with private settings activated and accessible to only a select group. for Nehal. Nehal. Knows Arabic · 2y ·. startstopcontinue.online?&q=Find%20Someone%20On%20Facebook%20Using%20Their%20Phone%20Number&handle=facebook. Upvote ·. If someone wants to find you on Insta or tag you in a picture, they'll type in your username to do so. A complicated name makes it more difficult for people. Parents: You follow your teen on Instagram, but do you know about their Finsta? “If I meet someone once, on normal Instagram I will follow them right away. My main account doesn't have my real name so no one in my real life can find The third account was just to see if I was blocked by someone or. Find and save ideas about finsta account profile pictures on Pinterest Can someone tell me where this is from please? #aesthetic #anime # · Instagram. If you forget or don't know your Instagram username, you can still log in using your phone number or email address associated with your account. An amazing coping mechanism, I know. It has been three months now since I have denounced social media. Instagram, Facebook, Twitter–nada. I would have to remind. “Finsta” accounts are most often a secondary Instagram account for an individual with private settings activated and accessible to only a select group. A finsta is an account one can create that has no ties back to them so they If you find an account that has a large number of people they follow. I'm not finsta chop up no garlic lol. Just Ellen Vandeven You bear a striking resemblance with someone I used to know where did you attend high school? Maintaining a finsta that people would actually find interesting find someone's TikTok page unless they tell you about it. Even. You know it is bad when a sorority expels someone for being a classist and a bully. The user provides evidence of Jodie Turner-Smith being listed as expelled.

Best Fha Loan Lenders For Bad Credit

How FHA Loans Benefit You · Down payments as low as % · Loan is guaranteed by the government · Less than perfect credit can apply · Energy-efficient mortgages. But if you are unable to qualify for something now, there is a good chance that making minimal changes to strengthen your credit will allow for better mortgage. Carrington Mortgage Services: Best overall · Guild Mortgage: Best for those with no credit history · New American Funding: Best for a variety of options · Rocket. With FHA financing you get the opportunity to buy a home with a as little as % down. The best part is you don't need a stellar credit score. We can finance FHA loans with as low as a credit score. Even bad credit FHA Mortgage loans are insured by the Federal Housing Administration. USDA Loans. Geared towards buyers in rural areas, USDA loans offer % financing options and lower credit score requirements that can go down to a credit. If your score is below , you probably should look into an FHA loan or VA loan. Of course, the best option is to work on repairing your credit score before. So if your credit score is lower, your best bet may be applying for an FHA loan. It's important to remember that different lenders could have different. The Federal Housing Administration (FHA) makes the program accessible for anyone to apply. Since this mortgage is insured through the government, many lenders. How FHA Loans Benefit You · Down payments as low as % · Loan is guaranteed by the government · Less than perfect credit can apply · Energy-efficient mortgages. But if you are unable to qualify for something now, there is a good chance that making minimal changes to strengthen your credit will allow for better mortgage. Carrington Mortgage Services: Best overall · Guild Mortgage: Best for those with no credit history · New American Funding: Best for a variety of options · Rocket. With FHA financing you get the opportunity to buy a home with a as little as % down. The best part is you don't need a stellar credit score. We can finance FHA loans with as low as a credit score. Even bad credit FHA Mortgage loans are insured by the Federal Housing Administration. USDA Loans. Geared towards buyers in rural areas, USDA loans offer % financing options and lower credit score requirements that can go down to a credit. If your score is below , you probably should look into an FHA loan or VA loan. Of course, the best option is to work on repairing your credit score before. So if your credit score is lower, your best bet may be applying for an FHA loan. It's important to remember that different lenders could have different. The Federal Housing Administration (FHA) makes the program accessible for anyone to apply. Since this mortgage is insured through the government, many lenders.

One of the best options as a first-time home buyer is an FHA loan. We Contact one of our experienced lenders to help find the right FHA loan for you. A Federal Housing Administration (FHA) loan is a great option for first-time buyers and those with less-than-perfect credit. Was wondering what the lowest credit score is acceptable for a FHA loan? There are banks that will offer low credit score loans, but if. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Carrington Mortgage Services is a good FHA lender for borrowers with low credit scores. It accepts scores as low as on its FHA loans and has flexible. FHA loans allow low- and moderate-income borrowers with poor credit to qualify for a mortgage. Forbes Advisor compares the best FHA lenders for you to. The FHA works with mortgage lenders, credit unions, and other loan institutions to provide accessible home loans to buyers. You can apply for an FHA loan. The minimum credit score needed to get an FHA loan through most lenders, including Rocket Mortgage®, is A few lenders do offer FHA loans with a minimum. loan to give you more options and greater savings. Apply Now. Bad credit home loan lenders Mortgage Investors Group. Getting a Loan with or Below Credit. USDA Loans. Geared towards buyers in rural areas, USDA loans offer % financing options and lower credit score requirements that can go down to a credit. Bad credit mortgage lenders: Lender options for bad credit home loans ; Carrington Mortgage Services, Low credit FHA loans. Low credit VA loans, (FHA and VA. You must have steady work: Since FHA mortgages rely less on stellar credit, lenders place more emphasis on employment. Can You Get an FHA Loan With Bad Credit. Compared to conventional mortgages, FHA loans can be easier to qualify for and allow for borrowers with lower credit scores. Here are NerdWallet's top-rated. One option to consider is a FHA loan. Along with not needing as much money down, FHA loans only need a minimum credit score of in order to be approved. Keep. FHA loans are backed by the Federal Housing Administration, which makes them less risky for mortgage lenders to offer and allows for lower credit score. Was wondering what the lowest credit score is acceptable for a FHA loan? Employers, landlords, lenders use credit score to judge your. If you're looking to buy a home but have poor credit, Blue Water Mortgage has access to a variety of home loan options for people with bad credit. FHA loans are insured by the government, which is why FHA lenders are willing to accept borrowers with poor credit. If you can meet the program's minimum credit. High credit score requirement: While you may be able to qualify for an FHA loan with a credit score as low as with some lenders, Guaranteed Rate requires. High credit score requirement: While you may be able to qualify for an FHA loan with a credit score as low as with some lenders, Guaranteed Rate requires.

$29 A Month Car Insurance

Get Car Insurance Under $ a Month. Start saving $s Right Now. Fast, Free Quotes. Online Rates as Low as $29 a Month. One of the newer features in car insurance is the practice of charging a low base rate with a per-mile charge (for instance, $29 a month and six cents a mile). It's like $29 a month if you drive less than 55 miles a day.? Is it real that someone can get car insurance for less than $ a month? Some of the cheapest car insurance companies with low upfront costs include Allstate, Progressive, and Nationwide. The cheapest states for car insurance are Iowa, Vermont and Nebraska, according to WalletHub's Cheap Car Insurance Study. They are the cheapest states for auto. USAA and Erie have the cheapest minimum liability car insurance rates, on average. This type of coverage will help you meet state liability insurance. Our carefully crafted policies start at an unbeatable $29 per month, blending economical pricing with the comprehensive auto insurance you deserve. Cheapest Auto Insurance in Arkansas (). The cheapest insurer in Arkansas is State Farm, which has rates as low as $29 per month. Anna Baluch. You can save up to $/year. * Our rates start at just $29/mo plus a few cents for each mile you drive. Get Car Insurance Under $ a Month. Start saving $s Right Now. Fast, Free Quotes. Online Rates as Low as $29 a Month. One of the newer features in car insurance is the practice of charging a low base rate with a per-mile charge (for instance, $29 a month and six cents a mile). It's like $29 a month if you drive less than 55 miles a day.? Is it real that someone can get car insurance for less than $ a month? Some of the cheapest car insurance companies with low upfront costs include Allstate, Progressive, and Nationwide. The cheapest states for car insurance are Iowa, Vermont and Nebraska, according to WalletHub's Cheap Car Insurance Study. They are the cheapest states for auto. USAA and Erie have the cheapest minimum liability car insurance rates, on average. This type of coverage will help you meet state liability insurance. Our carefully crafted policies start at an unbeatable $29 per month, blending economical pricing with the comprehensive auto insurance you deserve. Cheapest Auto Insurance in Arkansas (). The cheapest insurer in Arkansas is State Farm, which has rates as low as $29 per month. Anna Baluch. You can save up to $/year. * Our rates start at just $29/mo plus a few cents for each mile you drive.

For example, with Metromile you can get a California car insurance policy for a low monthly base premium that starts at only $29 per month. Then, you'll pay. The most affordable insurance company for an Envoy is Ohio Mutual, who offers liability only coverage for sometimes as low as $29 monthly, on average. In This. Pay-per-mile car insurance sets premiums based on how much you drive each month At Metromile, the base rate starts at $29 per month, followed by a fee. Metromile is a subsidiary of Lemonade, one of our top picks for homeowners insurance and renters insurance. Rates start at just $29 a month plus a few cents. Compare car insurance from + companies in our quoting tool, including GEICO, Allstate, Progressive. Save up to $ in minutes with no spam. And when drivers turn 75, auto insurance begins to cost even more, which is why many car insurance companies offer a variety of discounts for seniors. Car. If you're behind the wheel as much as the average American driver, you would pay about $72 for your mileage each month, in addition to that $29 base rate, which. Try this site where you can compare quotes: //startstopcontinue.online?src=compare// RELATED Will my insurance company repo my totaled car. For the average monthly premium paid Ohio cities, check out our breakdown below. City, Full Coverage Insurance, Liability Insurance Coverage. Dayton, $98, $ Car insurance is not just about the monthly cost, but being protected when life takes an unexpected turn. Nationwide offers dependable coverage with. The best cheap car insurance ; Erie Insurance - $ / month ; Travelers - $ / month ; USAA - $ / month. If you don't drive a lot, you shouldn't pay much for auto insurance. With Pay-per-mile car insurance, you could save hundreds every year. Pay-per-mile auto insurance works like this: First, you'll pay a consistent monthly rate that can be as little as $29/month. Then you'll have a low per-mile. The company offers average minimum-coverage costs of $29 per month or $ per year. For full coverage, Travelers's rates average $ monthly or $1, The cheapest liability-only car insurance is from State Farm, which also offers the most affordable option for high-risk drivers. How to lower my car insurance rates · Add multiple cars to your policy · Bundling auto and home policies · Pay for your policy in full · Complete a defensive. Liability insurance runs an average of $77 per month, while full coverage will cost you around $ When compared to the national average of all vehicles, the. Our carefully crafted policies start at an unbeatable $29 per month, blending economical pricing with the comprehensive auto insurance you deserve. Mercury provides cheap auto insurance without compromising on quality. Learn more about our cheap auto insurance policies in Texas. A bad credit score is going to cost you more than you think. Get the Cheapest Car Insurance in Florida. Fast, Free Quotes. Cheapest Rates From $29 a month.

Operating Expenses For A Business

Examples of operating expenses include rent, equipment, inventory, marketing, payroll, accounting fees, insurance, legal fees, office supplies, maintenance, and. Operating expenses = Sales Commission + Advertising expense + Salaries + Depreciation + Rent + Utilities. So, $ + $ + $ + $ + $ + $ Operating costs are the ongoing expenses incurred from the normal day-to-day of running a business. Operating costs include both costs of goods sold (COGS) and. Operating expenses, or OPEX, are the ongoing costs and expenditures a business incurs as part of its day-to-day operations to generate revenue. Operational expenditures are ongoing costs that support daily business. However, cloud computing, automation and as-a-service offerings have changed the cost. COGS: Direct Costs Of Producing Goods and Services · OPEX: Indirect Costs Of Running A Business · Accurately Calculating Profits · Identifying Areas For Cost. For businesses, operating expenses may typically include supplies, advertising expenses, administration fees, wages, rent, and utility costs. When it comes to. Operating expenses are costs required to keep a business going day to day, referred to as overhead they include SG&A (sales, general & administrative. Defining Operating Expenses · Rent & business rates. · Payroll. · Inventory costs. · Essential equipment. · Business insurance. · Employee benefits. · Pension. Examples of operating expenses include rent, equipment, inventory, marketing, payroll, accounting fees, insurance, legal fees, office supplies, maintenance, and. Operating expenses = Sales Commission + Advertising expense + Salaries + Depreciation + Rent + Utilities. So, $ + $ + $ + $ + $ + $ Operating costs are the ongoing expenses incurred from the normal day-to-day of running a business. Operating costs include both costs of goods sold (COGS) and. Operating expenses, or OPEX, are the ongoing costs and expenditures a business incurs as part of its day-to-day operations to generate revenue. Operational expenditures are ongoing costs that support daily business. However, cloud computing, automation and as-a-service offerings have changed the cost. COGS: Direct Costs Of Producing Goods and Services · OPEX: Indirect Costs Of Running A Business · Accurately Calculating Profits · Identifying Areas For Cost. For businesses, operating expenses may typically include supplies, advertising expenses, administration fees, wages, rent, and utility costs. When it comes to. Operating expenses are costs required to keep a business going day to day, referred to as overhead they include SG&A (sales, general & administrative. Defining Operating Expenses · Rent & business rates. · Payroll. · Inventory costs. · Essential equipment. · Business insurance. · Employee benefits. · Pension.

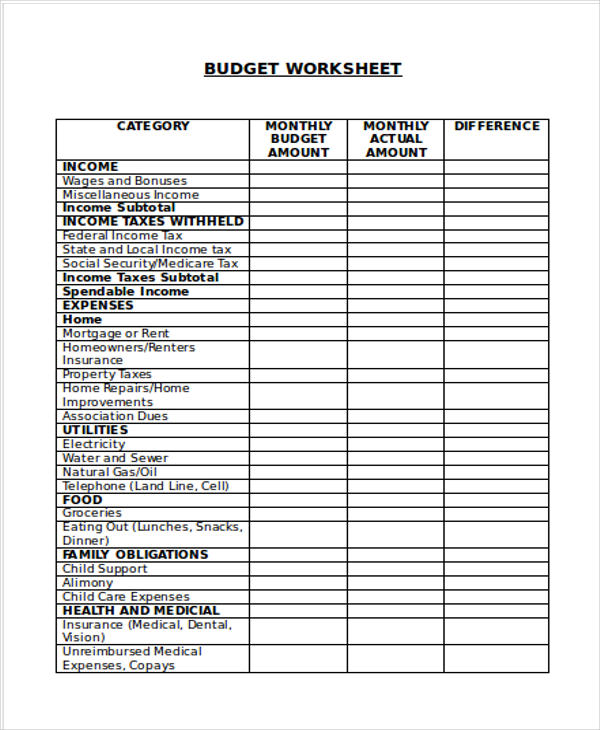

Note: We have discontinued Publication , Business Expenses; the last revision was for Publication , Net Operating Losses (NOLs) for Individuals. The SG&A line item frequently includes the sum of all direct and indirect selling expenses, as well as all general and administrative expenses of the reporting. Operating expenses are costs required to keep a business going day to day, referred to as overhead they include SG&A (sales, general & administrative. An operating expense is an expense that is related to a business's core operations. Operating expenses (OPEX) are the first expenses shown on a company's profit. To recap, operating expenses are the costs of running a business and may include costs such as rent, utilities, marketing and payroll. “Operating expenses are a. Business expenses are the operating costs of a business. Whether a given cost qualifies as a business expense is relevant because business expenses are tax. Operating costs are the known expenditures of a company. The most common reported operating cost is the net income or loss. Other operating costs include. Examples of operating expenses include rent, equipment, inventory, marketing, payroll, accounting fees, insurance, legal fees, office supplies, maintenance, and. Operating Expenses · Rent. Under many lease agreements, you'll be expected to provide the first month's rent plus a security deposit. · Phone and utilities. Simply put, operating cost is the sum of all of the things you pay for to run your business. Owning and running a business is expensive, and the operating cost. The operating expenses (OPEX) are the costs that a business incurs in running its operations. The company must invest these resources to execute its. What is an. Operating Expense? An operating expense is an expense that is related to a business's core operations. Operating expenses (OPEX) are the first. An operating expense (opex) is an ongoing cost for running a product, business, or system. Its counterpart, a capital expenditure (capex), is the cost of. Expenses and Expenditures provides information on business expenditures, operating expenses, research and development, product and process innovation. These include rent, salaries, and advertisements. What are operating and non-operating expenses? Operating expenses are expenses that keep a business running. Any of the expenses incurred by your business that are not directly related to the goods or services you produce can be referred to as operating expenses. They. Operating expenses refer to expenses that a business incurs through its normal operations, such as rent, office supplies, insurance, and advertising costs. Operating expense (definition) Operating expenses (often shortened to opex) are the costs of doing business. They're recorded on the profit and loss statement. Prepaid expenses · Accounting and legal fees · Advertising expenses · Business tax, fees, licenses and dues · Insurance expenses · Interest and bank charges. No matter how much money a business is bringing in, all companies have outgoings in the shape of operating expenses (OPEX). Find out more about operating.

Spdr S&P 500 Etf Annual Returns

The total return for SPDR S&P ETF Trust (SPY) stock is % over the past 12 months. So far it's up % this year. The 5-year total return is %. SPY Dividend. This section compares the dividend yield of this ETF to its Annual Dividend Yield, %, %, %. SPY Price and Volume Charts. View. As of August , in the previous 30 Years, the SPDR S&P (SPY) ETF obtained a % compound annual return, with a % standard deviation. It suffered. The Fund seeks to provide investment results that correspond generally to the price and yield performance of the S&P Index (the Index). The Funds. SPY ETF Stock Price History ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: A year by year calculation of the yearly returns of SPDR S&P using the actual trading prices SPY was at during each respective year. Performance returns for periods of less than one year are not annualized. Performance is shown net of fees. Index returns are unmanaged and do not reflect. The SPDR® S&P ® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P ®. 1 Year Total Returns (Daily) Benchmarks. iShares Core S&P ETF, %. SPDR® Portfolio S&P ® ETF, %. Vanguard S&P ETF, %. iShares Russell. The total return for SPDR S&P ETF Trust (SPY) stock is % over the past 12 months. So far it's up % this year. The 5-year total return is %. SPY Dividend. This section compares the dividend yield of this ETF to its Annual Dividend Yield, %, %, %. SPY Price and Volume Charts. View. As of August , in the previous 30 Years, the SPDR S&P (SPY) ETF obtained a % compound annual return, with a % standard deviation. It suffered. The Fund seeks to provide investment results that correspond generally to the price and yield performance of the S&P Index (the Index). The Funds. SPY ETF Stock Price History ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: A year by year calculation of the yearly returns of SPDR S&P using the actual trading prices SPY was at during each respective year. Performance returns for periods of less than one year are not annualized. Performance is shown net of fees. Index returns are unmanaged and do not reflect. The SPDR® S&P ® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P ®. 1 Year Total Returns (Daily) Benchmarks. iShares Core S&P ETF, %. SPDR® Portfolio S&P ® ETF, %. Vanguard S&P ETF, %. iShares Russell.

Trailing total returns ; S&P TR USD, +%, +%, +%, +% ; Fund quartile, 1st, 1st, 2nd, 1st. Performance ; , −%, % ; , %, % ; , %, % ; , %, %. Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change · 1 Year % Change The current dividend yield for SPDR S&P ETF as of September 11, is %. Compare SPY With Other Stocks. SPY Performance - Review the performance history of the SPDR® S&P ® ETF Trust to see it's current status, yearly returns, and dividend history. SPY tracks a market cap-weighted index of US large- and mid-cap stocks selected by the S&P Committee. The listed name for SPY is SPDR S&P ETF Trust. Ex-Dividend Date 06/21/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A. Performance charts for SPDR S&P ETF Trust (SPY - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Invests in stocks in the S&P Index, representing of the largest U.S. companies. Goal is to closely track the index's return, which is considered a gauge. So far in (YTD), the S&P index has returned an average %. Year, Return. , %. The index has returned a historic annualized average return of around % since its inception through the end of While that average number may. That means the average annualized return in SPY is roughly 10%. Additional return details are highlighted below. SPY ETF average returns by year Source. Therefore, SPDR S&P ETF allows investors to track the performance of the U.S. economy without having to buy all the stocks listed on the S&P directly. SPDR® S&P 's 3 year price total return is %.. View SPDR® S&P 's 3 Year Price Total Return trends, charts, and more. SPDR S&P ETF Trust (SPY). Overview: The SPDR S&P ETF is the But over time indexes have made solid returns, such as the S&P 's long-term record of. Annual Total Returns Versus Peers ; Name. ; SPDR® S&P ® ETF Trust. %. % ; S&P Total Return. %. % ; iShares Core S&P ETF. Vanguard High Dividend Yield ETF, Financial Sect SPDR Fund. Compare SPY - SPDR S&P ETF Trust. Select asset: Avantis Intl SCV ETF, Avantis U.S. See the dividend history dates, yield, and payout ratio for SPDR S&P ETF Trust (SPY). The SPDR S&P ETF Trust has generated an average annual return of just over 10% since its inception. Understanding the SPY ETF. As noted above, the SPY ETF. Current and historical performance for SPDR S&P ETF Trust on Yahoo Finance.

Mortgage Interest Paid Calculator

Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you to determine what your adjustable. Calculate your home mortgage debt and display your payment breakdown of interest paid, principal paid and loan balance. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. Mortgage interest is calculated as a percentage of the principal loan balance that you pay to borrow that money as determined by your interest rate. So, the. Use our mortgage payment calculator to estimate your monthly mortgage payment payment, interest rate and loan term. If you'd like a more precise estimate. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you to determine what your adjustable. Calculate your home mortgage debt and display your payment breakdown of interest paid, principal paid and loan balance. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. Mortgage interest is calculated as a percentage of the principal loan balance that you pay to borrow that money as determined by your interest rate. So, the. Use our mortgage payment calculator to estimate your monthly mortgage payment payment, interest rate and loan term. If you'd like a more precise estimate. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans.

Enter the dollar amount of the loan using just numbers and the decimal. Next, enter the published interest rate you expect to pay on this mortgage. Finally. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. A mortgage calculator that estimates monthly home loan payment While a 20% down payment will probably get you the best interest rates and. Mortgage Payment Formula ; M · Total monthly mortgage payment ; P · Principal loan amount ; r, Monthly interest rate. Lenders typically provide an annual rate, so. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. calculation – a monthly payment at a 5-year fixed interest rate of % amortized over 25 years. Don't worry, you can edit these later. Calculate. Mortgage. interest and shorten mortgage term. Modify values and click calculate to use The unpaid principal balance, interest rate, and monthly payment values can be. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more. To find out how you. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown. Enter your loan information. What is the principal of your loan or the initial loan amount? What is the interest rate on. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. It will quickly estimate the monthly payment based on the home price (less downpayment), the loan term and the interest rate. There are also optional fields. How Is My Interest Payment Calculated? Lenders multiply your outstanding balance by your annual interest rate, but divide by 12 because you're making monthly. Our calculator limits your interest deduction to the interest payment that would be paid on a $1,, mortgage. Interest rate: Annual interest rate for this. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay. A portion of your monthly mortgage payment will pay down this balance. Interest:This is an additional percentage added to your principal that lenders charge you.

Best Retail Stock App

Best investment apps in for all-round investors · Hargreaves Lansdown · AJ Bell · InvestEngine · Nutmeg · PensionBee · Plum · Lightyear – Stocks, funds and up to. Meet Composer, the automated trading platform and investment app. Build trading algorithms with AI, backtest them, then execute—all in one platform. Join the millions of people using the startstopcontinue.online app every day to stay on top of the stock market and global financial markets! Hatch: Best App or Platform for Low-Cost Investing in the US Markets · Tiger Brokers (NZ): Best Low-Cost Shares Platform · Stake: Best Platform for Extended. Saxo is widely recognized as one of the best apps for stock and CFD trading, offering a range of features that cater to both novice and experienced traders. Learn More. a screen for Tesla stock on thndr app. Why invest on Thndr Download Thndr and get started! App store logo on thndr home page آب ستور لوجو على. We chose tastytrade as the best options broker because of its low pricing for options trading, excellent technology for analyzing and trading options. Looking for an Indian Stock Market app with advanced features? Upstox is the one for you! Join Cr+ users growing their wealth right on Upstox! E*TRADE: Invest. Trade. Save. 4+. Stocks, options, mutual funds. E*TRADE Securities. Designed for iPad. Best investment apps in for all-round investors · Hargreaves Lansdown · AJ Bell · InvestEngine · Nutmeg · PensionBee · Plum · Lightyear – Stocks, funds and up to. Meet Composer, the automated trading platform and investment app. Build trading algorithms with AI, backtest them, then execute—all in one platform. Join the millions of people using the startstopcontinue.online app every day to stay on top of the stock market and global financial markets! Hatch: Best App or Platform for Low-Cost Investing in the US Markets · Tiger Brokers (NZ): Best Low-Cost Shares Platform · Stake: Best Platform for Extended. Saxo is widely recognized as one of the best apps for stock and CFD trading, offering a range of features that cater to both novice and experienced traders. Learn More. a screen for Tesla stock on thndr app. Why invest on Thndr Download Thndr and get started! App store logo on thndr home page آب ستور لوجو على. We chose tastytrade as the best options broker because of its low pricing for options trading, excellent technology for analyzing and trading options. Looking for an Indian Stock Market app with advanced features? Upstox is the one for you! Join Cr+ users growing their wealth right on Upstox! E*TRADE: Invest. Trade. Save. 4+. Stocks, options, mutual funds. E*TRADE Securities. Designed for iPad.

Best Online Brokers for Retail Stock · Plus Yield. Plus Review. Best For: Mobile Users · IBKR Stocks. Interactive Brokers Review. Best For: Active and. Learn about the Best Trading Apps in India- · PayTm Money · Zerodha Kite · Angle One App · Upstox Pro Trading app · Groww App · 5paisa App · ICICI Direct App. Stock is one of the best trading Apps in India, offering Zero Brokerage across products for life. With 25 years of rich global lineage, across 19+ countries. Alpaca's easy to use APIs allow developers and businesses to trade algorithms, build apps and embed investing into their services. eToro's Copy Trader feature is one of the reasons why the app has become the number one stock-trading platform today. The best phones are the ones with all the. Get alerted long before you run out of a best-selling item. Check inventory in and out instantly using Sortly's in-app barcode and QR code scanner. Start a Free. The first copy trading platform for stocks. It's like eBay for investing. Copy someone's investments or be copied. dub is a Broker-Dealer member FINRA. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. best possible price. Learn More. Icon Zoom. Options Trading. When you trade app on apple store download public app on google store. Public. Check the. Boost your Shopify store with apps for Inventory. Discover the latest free and premium apps on the Shopify App Store. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. The best overall stock trading app experience came from TD Ameritrade, one of the largest brokerage firms in the country. TD Ameritrade actually. Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. Fidelity was named NerdWallet's winner for Best App for Investing. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Vend helps you manage your inventory with ease. Its retail-focused features make it a top choice for stores looking to boost sales across channels. In addition. Paytm Money is India's best overall trading application as they provide lot of monetary benefits. Aside from that, the app has an easy-to-use interface and. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Boost your Shopify store with apps for Stock alerts. Discover the latest free and premium apps on the Shopify App Store. stock, ETF, and options trades per quarter). The retail online $0 commission does not apply to Over-the-Counter (OTC) securities transactions, foreign stock.